|

Certificate of Origin

|

You are here :Certificate of Origin > Application in Malaysia Application in Malaysia

By:Malaysia SW Update:2016-05-27

Electronic Preferential Certificate of Origin (ePCO)A quick way to prove the origins of your goods(1)A Preferential Certificate of Origin (PCO) is a document attesting that goods in a particular shipment are of a certain origin. This certificate is required by a country's customs authority in deciding whether the imports should benefit from preferential treatment in accordance with special trading areas or customs unions. It also enables products to enjoy tariff reduction or zero duty when the products are exported to other countries that participate in trade arrangements with Malaysia.

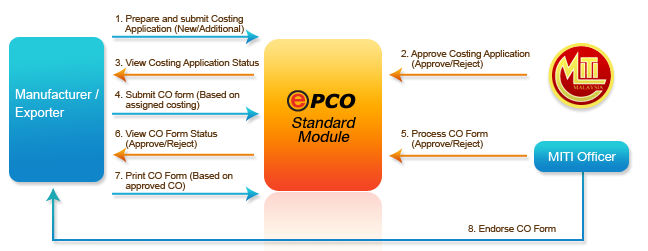

myTRADELINK's Electronic Preferential Certificate of Origin (ePCO) service makes it quick and easy to prove the origins of your goods. (2) electronic preferential certificate of origin (PCO E) Since January 2009, the introduction of electronic preferential import network of electronic certificates of origin application and approval system, and with the relevant regional cooperation arrangements, including the ASEAN Industrial Cooperation (AICO), the common effective preferential tariff (CEPT),ASEAN - South Korea free trade area, China - ASEAN Free Trade Area, Malaysia, Japan economic partnership agreement, Malaysia, Pakistan closer economic partnership agreement, GSP, textile origin proved that through electronic preferential rules of origin, it is proved that the Malaysian exporters can effectively use the free trade agreement of various preferential policies and preferential tariff arrangement. DescriptionA web-based Certificate of Origin application and approval system, the Electronic Preferential Certificate of Origin (ePCO) is an online document that certifies the country of origin of a product. This is to satisfy customs or trade requirements and also can be used as a supporting document for the issuance of a corresponding Certificate of Origin by other authorised parties.

Its other functions include: 1 Online application of Cost Analysis and Certificate of Origin forms 2 Online approval by authorised party e.g. Ministry of International Trade and Industry (MITI) 3 Allows online enquiry of application status  There are two methods in the declaration of origin namely the Certificates of Origin (CoO) and Self-Certification to claim the preferential tariff treatment. CERTIFICATION of ORIGIN (CoO)CoO (CoO) is a document that verifies the origin of the content (origin) of a product. The exporters determine their own certificates of origin in order to enjoy the preferential tariff treatment.

The CoO is issued by the authority appointed by the Member States of the ATIGA for exporters or producers who have complied with the rules of origin (RoO). It shall be submitted to the customs authorities in the country of importation for the purpose of claiming the preferential tariff treatment. Each CoO can only be used for one importation. SELF-CERTIFICATIONASEAN has introduced the 1st Pilot Self-Certification Project on 1 November 2010 participated by four (4) member states of ASEAN, namely Brunei, Malaysia, Singapore and Thailand.

The objectives of Self-Certification are to promote trade, reduce costs and time, facilitates the declaration of origin on commercial invoice/trade document which may only require minimum informations. The declaration of the origin shall be made on a commercial invoice/trade document issued by exporters as follows: "The exporter of the product(s) covered by this document (Certified Exporters No….) declared that, except where otherwise clearly indicated, the products satisfy the Rules of Origin to be considered as…………… Originating Products under………( ………………..) with origin criteria: …………………" COMPLIANCE TO THE RULES OF ORIGINThe Operational Certification Procedures (OCP) is the administrative guide to customs authorities and related parties in each ASEAN Member States. Among the rules of origin in the OCP which need to be complied with are as follows:

Original CoO or self-certification on commercial invoice/trade document must be produced at the time of importation; Only the CoO issued by the Issuing Authority of the exporting party is accepted; Preferential tariff treatment shall be applied to goods satisfying the requirements and which are consigned directly between the territories of the exporting member states and importing member states; Goods transported through one or more Member States, other than the exporting Member States and the importing Member State; or through a non-member state, provided that: the transit entry is justified for geographical reason or by consideration related exclusively to transport requirements; the goods have not entered into trade or consumption there; and the goods have not undergone any operation there other than unloading and reloading or any other operation to preserve them in good condition. For the purpose of goods in transit, the importers shall provide the bill of lading, CoO and the original commercial invoice/trade documents. DOCUMENTARY EXAMINATION ON CoO/SELF-CERTIFICATIONThe CoO/commercial invoice or trade documents submitted to the customs authority will be examined from these aspects:

whether a CoO or commercial invoice/trade documents is issued properly; the imported goods are matched with the goods certified in a CoO or commercial invoice/trade documents; and origin criteria of CoO are certified by issuing authority. After the assessment officers are satisfied with the information stated in the CoO or the trade invoices of the self-certification submitted, importers are eligible to enjoy preferential tariff as prescribed in the ATIGA. FACILITATION OF IMPORTATION UNDER BANK GUARANTEEIn exceptional cases whereby the CoO fails to be produced at the time of importation for certain reasons deemed acceptable by the Director-General of Customs, but the goods are listed under the ATIGA, the importers shall be allowed to pay the ATIGA rate under bank guarantee. The bank guarantee shall cover the difference of the total customs duties and other taxes imposed according to the AHTN 2012.

RISK MANAGEMENTRisk management is done by the Customs Verification Initiative Unit (CVI) located at Customs HQ. The targeting based is on selective criteria. CVI will tag targeted declaration in the system by giving instruction for assessment officers to take action accordingly.

LOSS OF THE CERTIFICATIN of ORIGINIn the event of theft, loss or destruction of a CoO (Form D), the exporter may apply in writing to the issuing authorities for a certified true copy of the original and the triplicate to be made out on the basis of the export documents in their possession bearing the endorsement of the words "CERTIFIED TRUE COPY". This copy shall bear the date of issuance of the original CoO. The certified true copy of a CoO (Form D) shall be issued no longer than one (1) year from the date of issuance of the original CoO (Form D).

VALIDITY PERIOD OF CERTIFICATION OF ORIGINThe Certificate of Origin (Form D) shall be valid for a period of twelve (12) months from the date of issuance and must be submitted to the customs authorities of the importing Member State within that period.

WAIVER OF CERTIFICATION OF ORIGINIn the case of consignments of goods originating in the exporting Member State and not exceeding US$ 200.00 FOB, the production of CoO (Form D) shall be waived and the use of simplified declaration by the exporter that the goods in question have originated in the exporting Member State will be accepted. Goods sent through the post not exceeding US$ 200.00 FOB shall also be similarly treated.

MINOR DISCREPANCIESWhere the ASEAN origin of the goods is not in doubt, minor discrepancies such as in the following can be accepted and the CoO shall not be rejected solely on this basis:

Spelling and/or tryping errors in the CoO. Size of tick marks and execution (either manual or typewritten), including crossed instead of ticked. Slight discrepancy in the authorised signature in the CoO and the authorised list of signatories. Different units of measurements stated in the CoO and supporting documents such as invoices/packing list and supporting documents. Minor differences in A4 paper size of the CoO. Minor discrepancy in ink colour (black or blue) of the text of the CoO. Slight differences in description in the CoO/Self-Certification and the supporting documents. RECORD KEEPINGEvery person who has possession of documents and records pertaining to valuation of goods imported shall preserve for a period of six years following the importation of the goods all records that relate to the purchase of, cost of, value of, payment for and disposal of the goods.

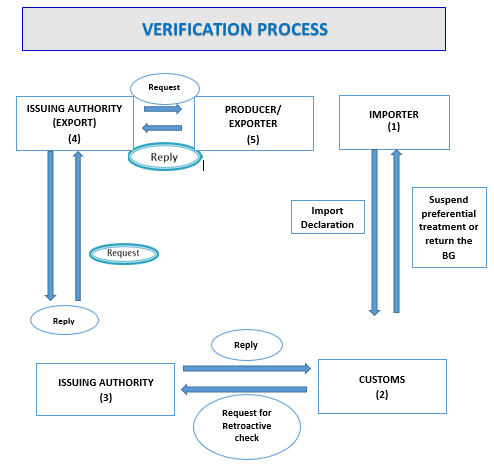

RETROACTIVE CHECK AND VERIFICATION OF THE COOThe RMCD may request the competent authority of the exporting Member State through MITI to conduct a retroactive check at random and/or when it has reasonable doubt as to the authenticity of the document or as to the accuracy of the information regarding the true origin of the goods in question or of certain parts thereof. Upon such request, the issuing authority of the exporting Member State shall conduct a retroactive check on a producer/exporter's cost statement based on the current cost and prices, within a six-month timeframe, specified at the date of exportation subject to conditions as stipulated in the Rule 18 of the ATIGA OCP for ROO.

Customs may suspend the provision on the preferential treatment while awaiting the result of verification. It may release the goods to the importer on the following conditions: Produce bank guarantee; Provided that they are not subjected to import prohibitions or restrictions; and No suspicion of fraud. Fraudulent act in connection with CoO or commercial invoice/trade documents that has been committed is an offence and will be subjected to penalties under the Customs Act 1967. DUTY-DRAWBACKIn the event of the importers could not provide the CoO at the time of importation and the duties paid according to the applicable Most-Favourite Nation's rate (MFN), the importers may request for duty-drawback and submit the application form (JKED No. 2), valid CoO and other supporting documents as required by the customs authority within one year from the date of importation.

|

| 中文 | English | Thailand | Vietnam | Indonesia | Malaysia | Philippine | Singapore | Brunei | Laos | Burma | Cambodia |

|

help |

|

online consulting |